About

Our "Practice Pitch Breakfast" is not a competition. It is a time for entrepreneurs and investors to fellowship, learn from each other and build relationships with one another no matter where we are located. Join us for our upcoming virtual "breakfast" where you will learn from companies practicing their pitch and gain insight from guest speakers on industry specific topics. Our goal is to come in as strangers and leave as family.

Practice Pitch Companies

|

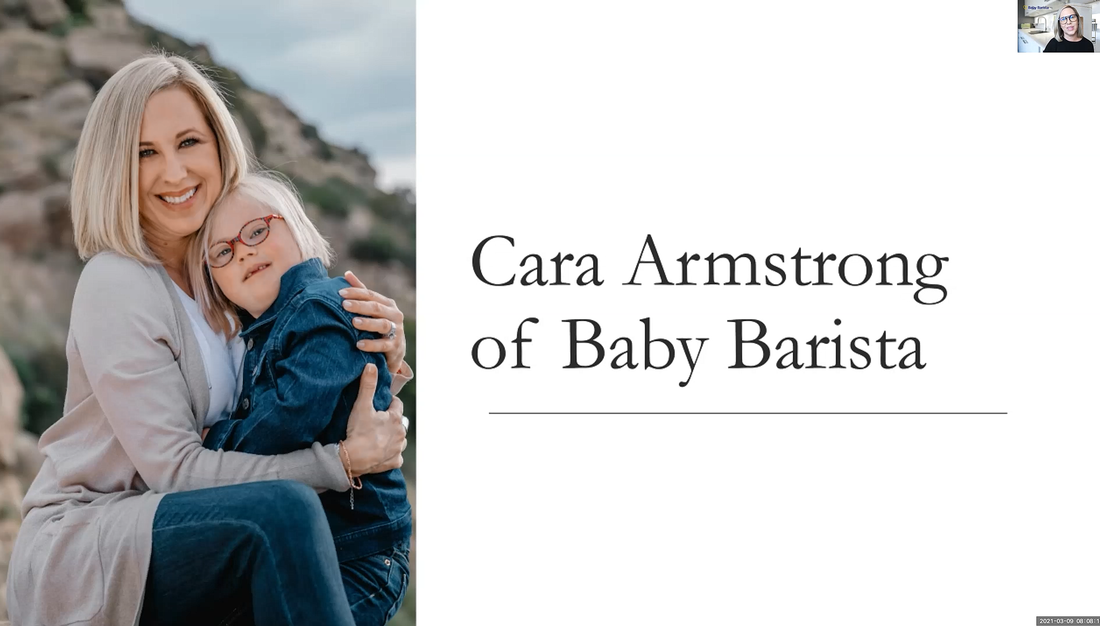

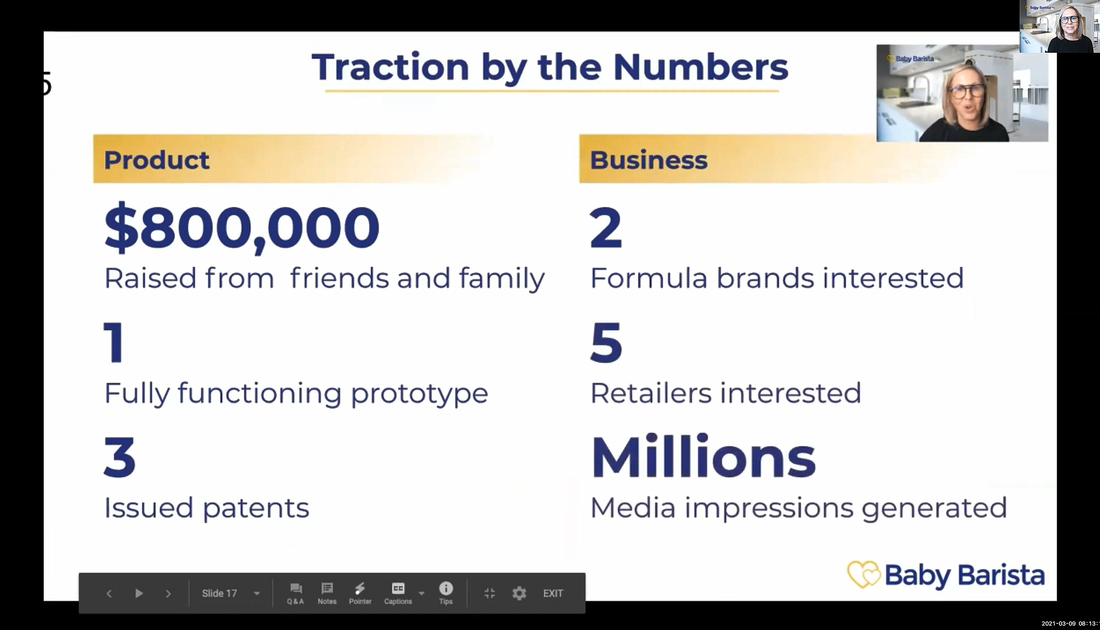

Baby Barista is on a mission to make infant formula simple. The Baby Barista ecosystem combines a patented “Nespresso-like” countertop appliance, premium organic formula in sterile packaging delivered right to your door, and a dedicated mobile app that allows remote formula preparation, feeding tracking, and formula supply management. With the press of a single button, parents can prepare the perfect bottle in under 30 seconds - exact concentration, ideal temperature, no bubbles (even from bed at 3 am).

|

Investor Pitch Feedback

|

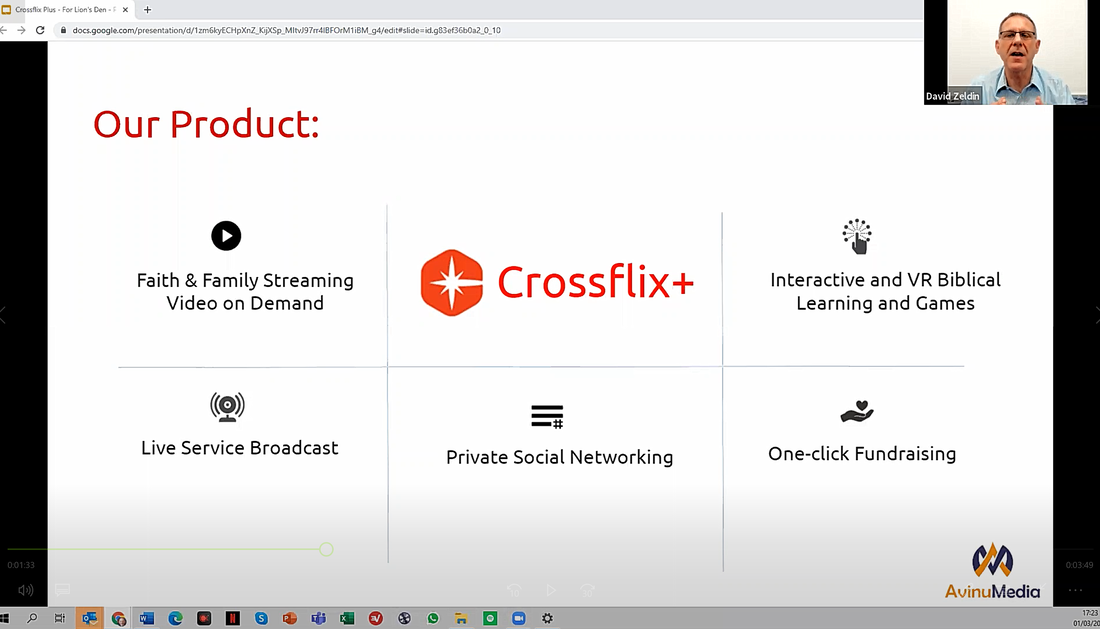

Avinu Media

|

Baby Barista

|

Guest Speaker

|

Your Thoughts

"Love the energy and the opportunity to learn business from entrepreneurs' perspective."

About Avinu Media: "It was good on how clear they are differentiated from the competition. Needed more on path to profitability. Also would be helpful to have one screen on the team and their credentials and expertise and role within team. And somewhere feature organizations, partnerships or champions."

About Baby Barista: "Excellent. Winsome, easily understood, touched on many points, visually pleasing graphics and presentation, entrepreneur is articulate and trustworthy. Only thing I would add is to mention the 3 patents and Intellectual property protection plan."

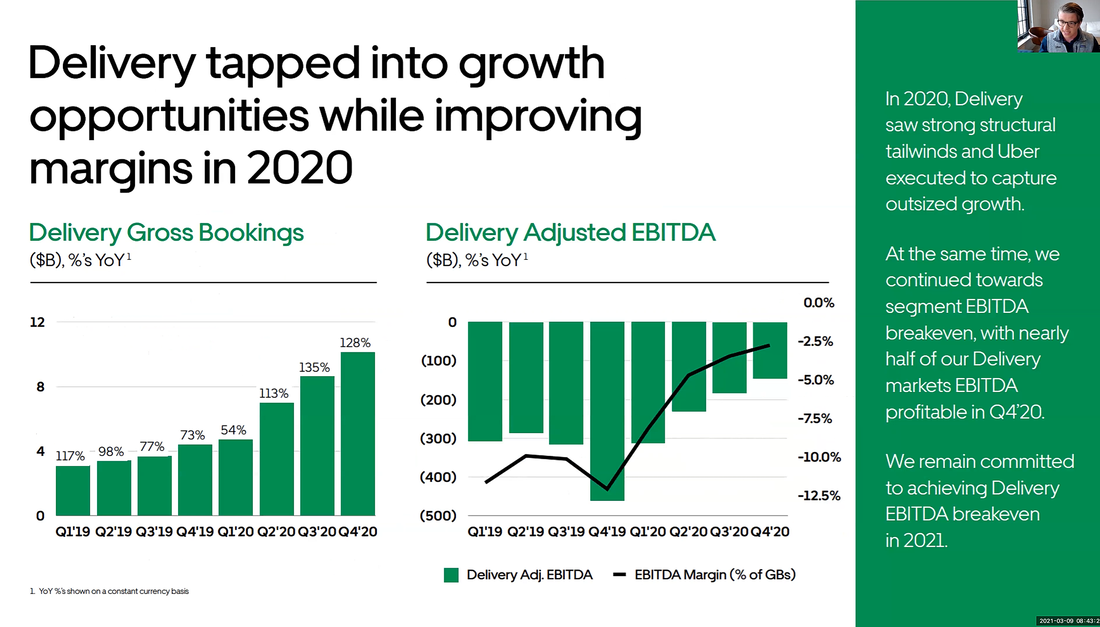

About Skyler: "Very informative, Presentation was visually pleasing, speaker was articulate and knowledgeable, and put it in a historical and global context. Only thing I would say is put the problem upfront— innovation in transportation like Uber is trying to solve the urban congestion problem."

"Made some interesting new connections."

"The investors made positive and constructive comments and asked good questions that helped clarify the investment thesis."

While impressed with the pitch, the investors still found good questions to ask and comments to make. I love Doug's comment "It's a good thing you have a competitor..."

About Skyler: "Very professional presentation and very informative perspectives on the transportation industry.

"One of the best ones yet."

"The investor's feedback was really impressive."

About Avinu Media: "Daniel Zeldin and his team did a great job with the concept of Crossflix+."

About Baby Barista: "I really love the Baby barista concept. Cara Armstrong is doing a really great job with that."

"The feedback was really informative. I love the freedom to share ideas."

"The event was a great on for me. I never was disappointed attending. I am to looking forward to the next one actually"